unlevered free cash flow vs fcff

Includes interest expense and mandatory debt repayments but. Fcff is also referred to as unlevered.

Unlevered Free Cash Flow Definition Examples Formula

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

. It is vital to understand FCFF vs. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. FCFE levered free cash flow.

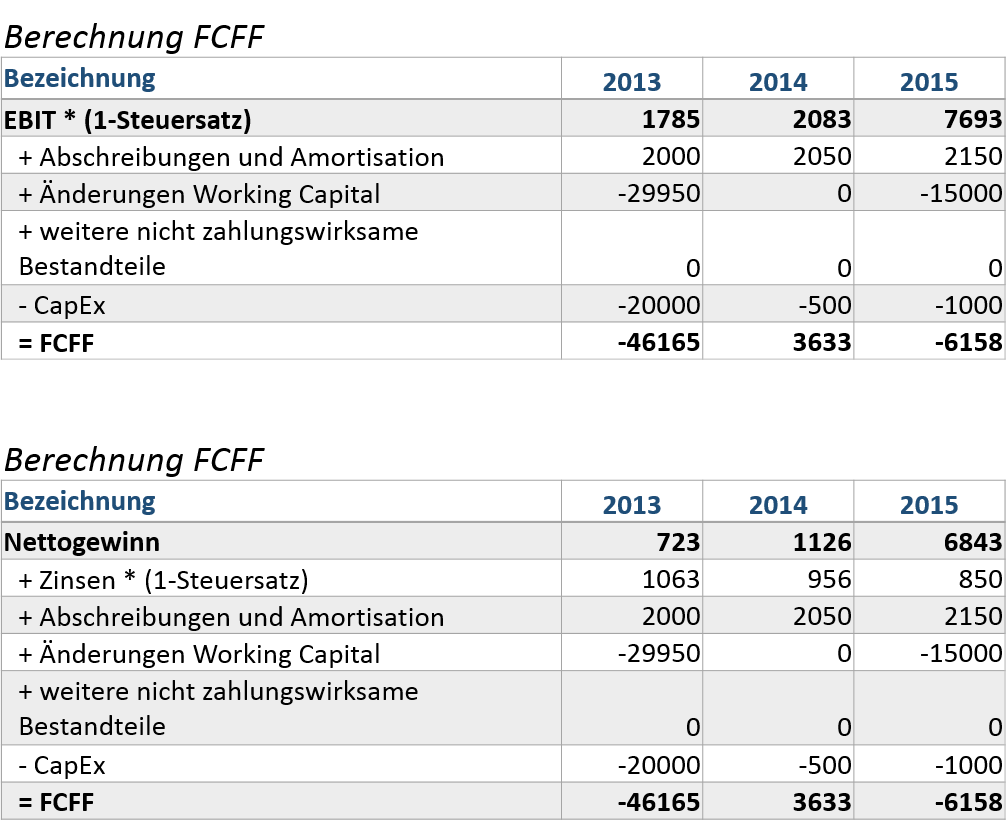

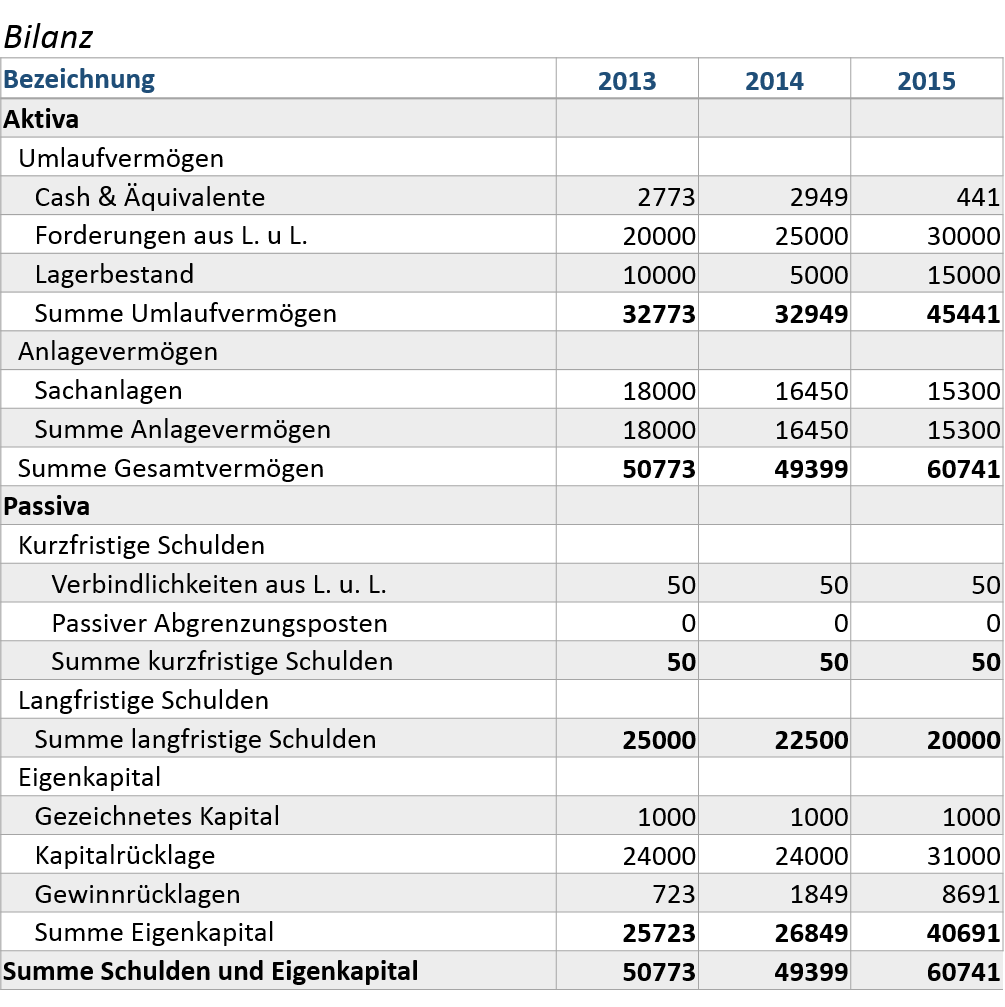

Unlevered Free Cash Flow. Free cash flow to the firm ie FCFF and Free cash flow to equity ie FCFE are two different forms of free cash flow measurements used in valuation. The FCFF and FCFE which are acronyms for Free Cash Flow for the Firm and Free Cash Flow to Equity are the two types of free cash flow measures.

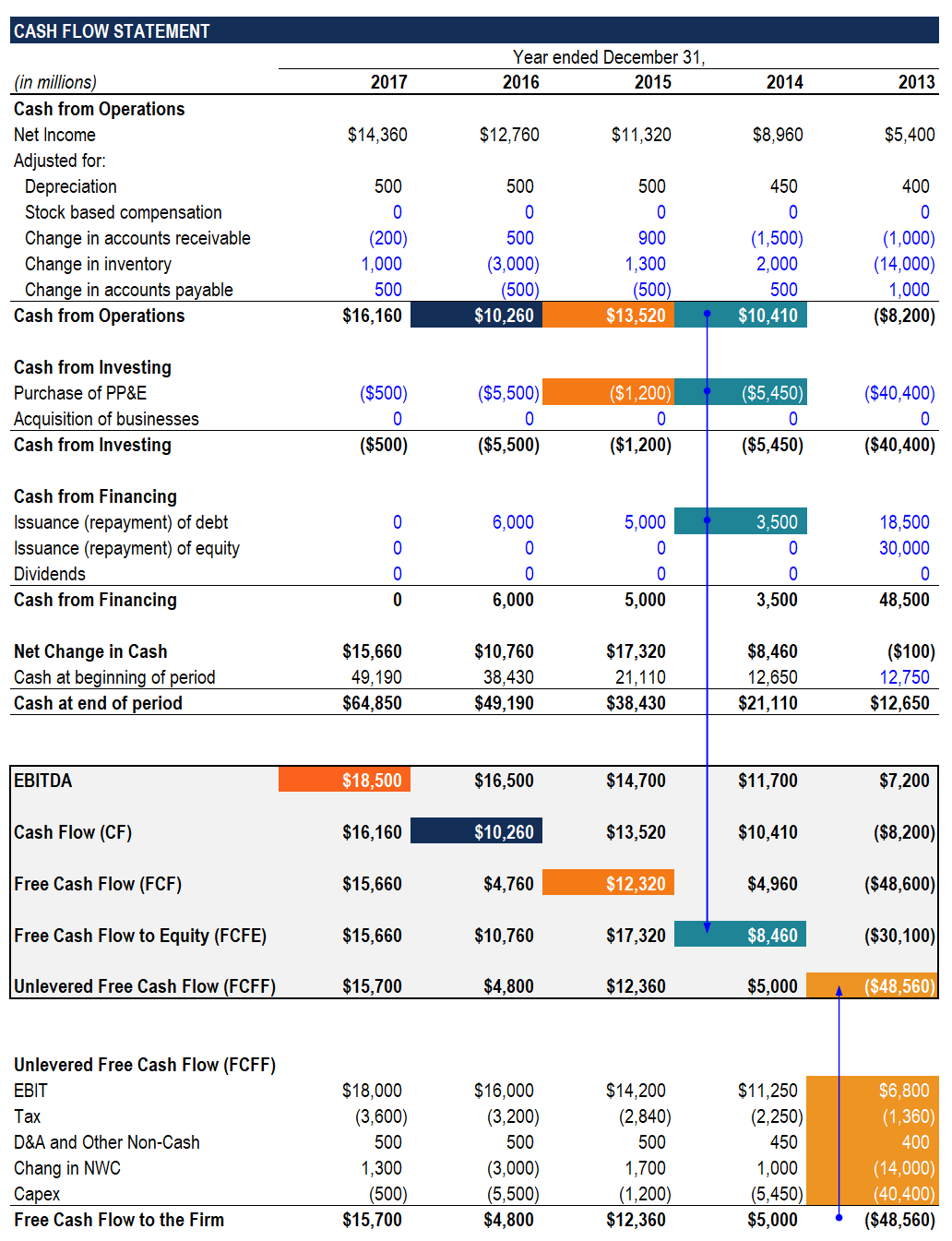

Free cash flow is arguably the most important financial indicator of a companys stock valueThe valueprice of a stock is considered to be the summation of the companys expected future cash flows. The formula below is a simple and the most commonly used formula for levered free cash flow. FCFE because the numerator and discount rate of multiples largely depend on the methods of cash flow used.

Download templates for cash flow forecasts cash flow statements cashbook petty cash and more. A complex provision defined in section 954c6 of the US. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes.

Unlevered Cash Flow cannot be considered in isolation because it does not incorporate the payments that are to be made to the debt holders. FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Free cash flow is the cash that a company generates from its business operations after subtracting capital. The look thru rule gave qualifying US.

Unlevered free cash flow can be reported in a companys. It is also thought of as cash flow after a firm has met its financial obligations. Free cash flow otherwise known as FCF is the cash that a.

There are various ways to compute for FCF although they should all give the same results. Operating cash flow measures cash generated by a companys business operations. Companies will pay the financial obligations from levered free cash flow.

Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business. Unlevered Free Cash Flow - UFCF. Free cash flow to firm FCFF Free cash flow to Equity FCFE 1.

Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise. Cash flow is available for equity shareholders only. For this scenario unlevered free cash flow is the before state and levered free cash flow is the after state.

Levered cash flow as leverage impact is included. Apple stock earnings and free cash flows. It is the ability of a company to generate cash for its capital expenditure.

Internal Revenue Code that lowered taxes for many US. Operating EBIT is normally adjusted for non-cash expenses as well as fixed and working capital investments to arrive at FCFF. Of those using discounted free cash flow models FCFF models are.

Levered beta contains the risk related to equity holder and debt holder Similarly FCFF is the one considering both equity and debt. FCFF unlevered free cash flow. The action in between is the settlement or payment.

Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors. Excludes interest expense and ALL debt issuances and repayments. Unlevered cash flow as leverage impact is excluded.

Most information needed to compute a companys FCF is on the cash flow statement. Cash flow is available to all the investors of a firm. Levered Free Cash Flow is considered to be an important metric from the perspective of the investors.

Free cash flow ie fcf of a company is 1145000. Levered Free Cash Flow. Think about these types of cash flow in terms of a before and after state.

The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Free Cash Flow Operating Cash Flow CFO Capital Expenditures.

What is Levered Free Cash Flow. We usually refer to FCFF when we speak of free cash flow FCF. Includes interest expense but NOT debt issuances or repayments.

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Das Abc Des Free Cash Flow To Firm Fcff Diy Investor

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates